Blogs in English

Game Changers in Nordic in-store Payments (?) - 3 /2017

Similar kind of announcement as above you can see more and more in Nordic stores. The use of cash is decreasing (5-10% pa) and governments strongly support this tendency. In Sweden the national Bank (Riksbank) plans a national digital currency to replace the physical money. According Niklas Arvidsson, an associate professor specializing in payment systems innovation at Stockholm’s Royal Institute of Technology (KTH), “thinks, that in practice, Sweden will pretty much be a cashless society within about five years” Five years sounds like an optimistic time plan, but there are interesting development happening in the Nordic in-store payment market.

The biggest bulk of consumer to business (C2B) payments are done instore. As of today instore payments are already dominated by cards and especially by debit cards. In all Nordic countries debit card transactions represent more than 90 % of card payment transaction volume and at least 80 % of the total value of card payments. Even though Nordics seems from a distance a homogenous Retail & Payment -market there are differences between the countries. Instore payments in Denmark and Norway are mostly done with local national debit schemes Dankort (DK) and BankAxept (NO). In Finland and Sweden debit cards are based on international card schemes (Visa & Mastercard).

Contactless card payments speed up

Volumes are evolving quickly especially in low value payments substituting both usage of cash and chip and PIN card payments. In Finland contactless volumes rises rapidly (already + 15 % of total volume). In Denmark Dankort Contactless was launched in 2015 and today 60 % of Dankort transactions are done with contactless enabled terminals. In Sweden and Norway contactless payments are still in ramp up phase. In Norway Bankaxept contactless was launched in Q4/2016 and will be part of all BankAxept cards issued and new terminal installations starting from summer 2017. Also Swedish banks have started to issue cards with contactless capability.

Mobile wallets are coming (finally)

The number of Europeans regularly using a mobile device for payments has tripled since 2015 (54% vs 18%)In Nordics more than 80 % of consumers have used mobile payments according to Visa Digital Payments study.

Still most of the mobile payments are “traditional” online payments via mobile browser in tablet or in smartphone, but app-commerce and the use of a phone as a substitute for a card grows rapidly. Especially in-app payments (app-commerce) is expected grow rapidly in coming years (+ 50 % CAGR), but also the use of phone as form factor at POS is growing steadily. App commerce as such with its digitalization and omnichannel capabilities will be a game changer for sure* but now the focus is on POS-payments.

* will be a topic of next blog

Denmark leads in mobile payments

In Nordics there are several important mobile payment schemes or initiatives, which support also instore payments. Most of them are either based on card payment infrastructure or instant account to account payment infrastructure. Denmark is the most advanced mobile payment market in Nordics. The biggest success story so far has been MobilePay, which has in 3 years managed to build significant transaction volume and a merchant base of 8 000 merchants. MobilePay has also spread outside of Denmark to Finland and Norway but usage in those countries are still small compared to Denmark. The competition will become harder now when Dankort operator Nets has entered in mobile payment market with its Dankort Mobile solution. The solution is based on existing card payment infrastructure, which makes the deployment easier than in MobilePay. The battle of market leadership between MobilePay and Dankort Mobil has moved to price competition, which has already lowered merchant service charges (MSC). This will probably speed up the mobile payment acceptance even more.

In Norway there are several mobile payment initiatives. All of them are mainly focusing on Person to Person (P2P) payments but consumer to business (C2B) payments are on roadmap and in rise also instore. Most popular mobile payment scheme is DNB’s Vipps, which has more than 2 million users. Sparebanken 1’s mCash and MobilePay has both around 0,5 million users. Similar way than in Denmark also in Norway the local debit card scheme operator Bankaxept As will launch its Mobile solution during 2017, which might change the market development significantly. Market expansion wise Norway is behind Denmark and it will probably at least 2 years before significant volumes are generated.

In Sweden the interbank co-operation driven instant payment scheme Swish has built up a huge userbase with more than 5 Million users. Also Swish is still mainly used for Person to Person Payments, but online and instore (C2B) payments are growing. Swish is an interbank joint venture providing infrastructure for instant account to account payments. Each bank is providing the service to its customers and banks remain their position as owners of the customer relationship. This is good for the banks to secure their business in disrupting banking scene and good for Swish to secure its position as the main instant payment scheme in Sweden.

There is a similar initiative ongoing run by Automatia OY, which is the dominant ATM service provider in Finland and owned by the main banks. This initiative is called Siirto and it is using Automatia’s realtime payment platform to initiate instant account to account payments first between persons (P2P), but presumably later also (C2B) payments both online and instore environments. Similar way as in Sweden also in Finland banks will brand their own services and own their own customers. Siirto provides backend services and interoperability between the banks and with 3rd party PSPs. Nordea bank was the first bank, which launched their Siirto based P2P payment product in the beginning of March 2017. The strong challenger for Siirto - services is MobilePay, which is the most widely used mobile payment solution in Finland today (+400 000 users), but consumer to business volumes are still very low.

The challenge with instant (account) payments in store is that the acceptance need new infrastructure (HW + SW) and new processes from the merchant. The interaction with POS is not standardized as it is with card payments but different schemes uses different methods like QR-codes, BLE or even manual entry of transaction ID. The same challenge is also in the settlement and reconciliation side where more sophisticated merchant services are still needed. The good thing is that consumers love them and on top of them you can create value added services both for consumer and for the merchants.

masterpass and Samsung Pay are coming

Same time as instant payments are evolving the banks (issuers) in Finland and Sweden are also launching their mobile wallets for card based payments. One of the pioneers had been telecom operator Elisa, which have now sold their wallet to Aktia Bank. OP-Pohjola in Finland have their PIVO mobile wallet and Nordea bank in Finland have their Nordea Pay.Just recently Nordea Bank in Sweden announced that they start to pilot Samsung Pay as part of their Nordea Wallet solution, which then enables instore payments with mobile device. Mastercard with its masterpass has put a lot of effort to launch masterpass in Nordics. In Finland at least Nordea bank and Aktia bank will launch their masterpass based mobile wallets also for instore use. Also in Sweden Swedbank, Nordea Bank, SEB, Ica Banken and Resurs Bank have launched masterpass but only in online for the time being. The challenge with NFC based mobile wallets is Apple. As long Apple Pay is not supported by issuers the whole consumer market cannot be covered. For merchant acceptance NFC based wallet is a perfect match, because the full interoperability with existing POS infrastructure and back end processes are already there.

Klarna enters into physical store

Alternative stream in mobile payment development is invoice/consumer finance based payments, which have gained a big market share in eCommerce especially in Sweden. One of the pioneers has been Collector Bank, which has co-operated with Seamless SEQR for many years with their QR-code based mobile wallet solution. SEQR support also instant account payments. In 2016 Klarna the game changer in eCommerce launched its own Klarna Offline payment solution for instore payments. Consumer finance and longer payment times will certainly attract certain market segments especially if it is linked to higher user experience for consumers and higher conversion for the merchants.

The new Payment Service Directive (PSD2), which comes into force in 2018, will speed up the launch of alternative payment methods (APM) and the entry of new players by providing common legal framework for payment services and by ensuring better protection for consumers.

Fragmentation is the game changer

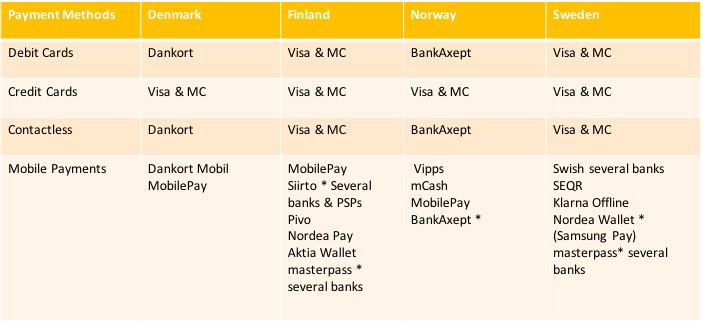

There is not any single game changer in Nordic in-store payments except fragmentation of payments and the continuous evolution (see the table below).

*To be launched during 2017

Main Instore Payment methods /new initiatives in Nordics

It seems that Nordics are not becoming one homogenous payment market but the national differences will continue and at the same the preferred payment mix will become wider also inside the countries. Mobile payments are preferred by especially younger consumers and will grow rapidly, but the dominance of debit card payments will continue for years. "FinTech" boom & PSD2 will accelerate the launch of new payment methods.

Merchant define your payment strategy

Fragmentation is a big challenge for merchants and especially for cross border merchants acting in several (Nordic) countries. More complicated environment needs a payment strategy and planning. You have to know the preferred payment mix of your target customers, choose the right service providers and optimize your payment costs. Otherwise the work and costs related to payment acceptance can increase significantly.

The author of this blog is Päivö Eerola Founder & CEO of Pin'Jo. The company provides advisory and consulting services for merchant and other stakeholders in payments within the Nordics.

Merchant's Check list for Payments

Payments used to be "the simple part" of retail. You just accepted cash and cards and all the consumers were satisfied. That is not the case anymore. Retail Payments are in disruption. FinTech booms, regulation changes and consumers digitalize their behavior. The following checklist will give merchant an insight where to focus with payments.

1. Do You offer the right payment options to your clients?

Consumer behavior changes rapidly and the payment preferences in different demographic groups variate and change. Millenniums want to use mobile and instant payments. Cash is still king in some areas but vanishes rapidly on others. Cards are preferred but more and more with NFC/Contactless. In certain product areas consumer finance based payments are a must. Payment options are important reason consumer to abandon their cart especially in online stores. According to recent study 40 % of consumers consider not to buy if the preferred payment method cannot not be used. Merchant has to be aware of the preferred payment options of his clients. If the payment portfolio is not uptodate, it will be a big hinder to sales.2. Can You provide same user experience and smooth payments cross the channels?

Brick & Mortar and eCommerce merge to become omnichannel commerce. Consumers want to have similar access to retailer’s offering in online, in mobile and in physical store. Omnichannel access means that consumer may be able to order online and pick up the store; order at store and arrange delivery online, It also means that merchandise bought online can be returned to store and is refunded there and vice versa. Consumers want same payment options in all channels and the merchant must be able to handle also the exceptions like add value / refund payment transaction cross the channels.

3. Does your settlement and reconciliation process cover all channels and all payment methods?

The most successful merchant's I've worked with are very cost conscious and have automatized all routine work like settlements and reconciliations. By doing this a merchant can create significant savings both in labour and in bank payments. This will become even more important in the fragmented payment scene of the future.

4. Are You sure that you are in the same cost level as your competitors?

New regulation in EU-region, like Multilateral Interchange Fee (MIF) regulation in card payments and the coming PSD2 in all payments, has increased and will increase competition, which will decrease the prices. But price reductions are not given to you. It requires activity. By putting out to tender will on average create a 5-10 % savings on yearly payments costs paid to external service providers.

5. Do You have a Plan?

Environment changes rapidly and the number of Payment Service Providers and Payment methods will explode in the coming years. This create a challenge to merchants. To choose the right payment methods and to keep the costs related to payments in control is vital for success. This requires planning and proactivity. A payment strategy or at least a roadmap how to react on changing environment has to be in place..

The writer Päivö Eerola is CEO and founder of PIN,JO. See more about PIN.JO's payment optimization package at www.pinjo.fi

Order our newsletter:

Sign up for our newsletter and you will receive information / blogs about digitalization of commerce and payments